The Truth About Life Insurance With Rheumatoid Arthritis

Each year, approximately 200,000 new cases of rheumatoid (RA) are diagnosed, usually in women. The truth about life insurance with rheumatoid is you can purchase life insurance with RA. If you have been declined traditional life insurance, know that, with an expert who understands your specific condition, there are options.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Life Insurance Expert

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Life Insurance Expert

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Imagine, if you will, a situation in which the reality was much different than the perception. Take the movie, Beauty and the Beast, for example.

A tale as old as time. Here, we have a ghastly beast who is feared by all.

The truth is, the beast is actually a rich prince who needs to open up his heart.

Securing life insurance with rheumatoid arthritis (RA) is similar to that tale. Reality and perception aren’t the same.

The truth is, while it’s often complex, you can purchase life insurance with RA. It’s not the beast we make it out to be.

We’ll explain the following to help you make a wise choice:

- Summary of Rheumatoid Arthritis (RA)

- How RA Affects Life Insurance

- Process of Obtaining Life Insurance

- What To Do If You Are Declined Life Insurance

- Securing Best Life Insurance Rates

Summary of Rheumatoid Arthritis (RA)

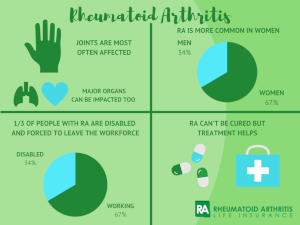

A common condition, Rheumatoid arthritis (RA) affects more than 1.5 million Americans. Each year, approximately 200,000 new cases are diagnosed, usually in women.

Rheumatoid arthritis (RA) is the most common type of autoimmune arthritis. It is triggered by a faulty immune system (the body’s defense system) and affects the wrist and small joints of the hand, including the knuckles and the middle joints of the fingers. -American College of Rheumatology

- Tender, warm swollen, joints

- Symmetrical pattern of affected joints

- Joint inflammation often affecting the wrist and finger joints closest to the hand

- Joint inflammation sometimes affecting other joints, including the neck, shoulders, elbows, hips, knees, ankles, and feet

- Fatigue, occasional fevers, a loss of energy

- Pain and stiffness lasting for more than 30 minutes in the morning or after a long rest

- Symptoms that last for many years

- Variability of symptoms among people with the disease

RA is chronic and progressive, meaning that it typically lasts years, and as time passes, can increase in severity. For some, joints are the only body part affected. Others experience more complicated symptoms:

- Anemia (low red blood cell count)

- Vasculitis (inflammation in blood vessels)

- Pleurisy (inflammation in lining of lungs)

- Pericarditis (inflammation in the sac enclosing the heart)

- Depression or anxiety

Early intervention and proper care provide the best opportunities for a positive outlook. Your rheumatologist, or rheumatoid arthritis doctor, will collaborate with you to formulate a favorable plan.

Goals for treating and managing RA should be proactive, and include pain management, reduction of inflammation, slowing of joint damage, and an improvement in your sense of well-being.

The Mayo Clinic recommends a comprehensive method for RA management:

- Medications – NSAIDS (non-steroidal anti-inflammatory drugs), steroids, DMARDs (disease-modifying antirheumatic drugs), and biologic agents

- Physical Therapy and/or Occupational Therapist

- Surgery – joint and tendon repair, if necessary

- Alternative medicine – plant and fish oils, acupuncture

- Lifestyle – low-impact exercise, stress management, and healthy diet

For a more in-depth overview of rheumatoid arthritis, click here.

Read more: Life Insurance and Rheumatoid Arthritis

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

How RA Affects Life Insurance

When applying for life insurance, there are some key factors that insurance carriers will want to know about your rheumatoid arthritis.

Underwriters (people responsible for assessing risk) will ask you questions about: the date of your diagnosis, duration and frequency of flareups, any deformities from RA, any disabilities from RA, the parts of your body affected, and what RA medications you take.

The more risk a particular client poses, the higher their premiums will be. At some point, and each life insurance company is different, the risk is considered too high for the company to absorb and a decline is given for traditional life insurance.

What is important to remember, however, is that there’s always life insurance options for you.

Process of Obtaining Life Insurance

In addition to evaluating your rheumatoid arthritis, life insurance companies want an overall sense of how healthy and safe you are. Expect questions about your RA, general health, family history, occupation, and lifestyle.

After submitting an application, you will complete a process known as underwriting for traditional fully-underwritten life insurance.

A paramedical company working with your carrier will send out a certified medical professional (a paramed) to conduct the medical tests and send the results to the company’s underwriter. The underwriter will then evaluate the results and determine if it is in their best financial interest to insure you. That risk assessment determines your life insurance rates. The greater risk you pose, the higher your premiums, until the company decides it can’t cover you at all. – Life Happens, How to Take a Life Insurance Medical Exam

Parameds measure your height, weight, and blood pressure. They take samples of blood and urine, a mildly inconvenient process.

Those little vials of liquid provide life insurance companies data to determine what health class (rating) you qualify for.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

For example, test results include your cholesterol levels, what medications (or drugs) you may be taking, the amount of sugar in your blood (possible diabetes), and how well your major organs are functioning.

The exam is completely confidential. Tests take about a week or two to process.

A copy of your results will be sent to you. Based on your underwriting results, insurance companies will offer you:

- Standard Approval – You are approved for traditional, fully-underwritten life insurance. Best case scenario.

- Rated Approval – You are approved for traditional, fully-underwritten life insurance, but a surcharge of 25-200% will be added to your premiums.

- Decline – You are not approved for traditional, fully-underwritten life insurance. Don’t despair. Options are still available to you.

Read more:

- Will the life insurance medical exam impact the approval timeline for my life insurance policy?

- Can you get life insurance when you have arthritis?

What To Do If You Are Declined Life Insurance

A life insurance decline can happen for different reasons. Due to HIPPA (Health Insurance Portability and Accountability Act), your agent will likely not know why the decline happened.

However, that information is always available to you, the client. Here are a few common reasons individuals with rheumatoid arthritis have received a decline of life insurance:

- Major physical deformity as a result of RA

- RA has affected major organs, like your heart or lungs

- Inability to perform daily tasks and are disabled from RA

In addition, a decline of life insurance can happen that is unrelated to rheumatoid arthritis:

- Driving record

- Criminal history

- Drug use (non-medical)

- Medical conditions unrelated to RA (i.e. stroke, cancer)

- Risky hobbies or occupation

If you have been declined traditional life insurance, take a deep breath and know that there are options. First, the best thing you can do is to reach out to an expert who understands your specific condition.

Each client is unique and it’s imperative to have agents working for you who understand the complexities of rheumatoid arthritis. In fact, it’s possible to have an applicant reapply for life insurance, even after a decline, and be approved.

The approval comes when a knowledgeable agent applies with the right life insurance carrier and presents the application positively and appropriately.

Other life insurance options are available to you, even if traditional life insurance is not. For example, a graded benefit life insurance policy can work for those that don’t qualify for fully-underwritten life insurance.

Remember, there’s always a means for you to financially protect your loved ones.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Life Insurance Expert

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Life Insurance Expert

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.