Can you get life insurance while pregnant?

Being pregnant doesn’t affect your life insurance options, but the potential complications that come with pregnancy could impact pregnancy insurance rates.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Life Insurance Expert

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Life Insurance Expert

UPDATED: Mar 26, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 26, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you are thinking about having a baby or are pregnant, it’s smart to consider life insurance.

Insurance needs compound when your family grows. In fact, pregnancy is a top motivator for purchasing life insurance.

One in three women think they don’t have enough life insurance. – Insurance Barometer Study, Life Happens and LIMRA

As you balance a whirlwind of appointments and plans, be sure to move “purchase life insurance” to the top of your to-do list.

There are a few things to keep in mind if you’re a pregnant woman looking for a life insurance policy that will protect you and your family. Should there be any pre-existing conditions for example, your insurance company will need to be aware of them.

We’ve compiled a list of questions commonly asked when it comes to pregnancy life insurance, hopeful that the answers will help ease at least a little of the anxiety that comes with this exciting and nerve-wracking time.

Can I qualify for life insurance if I am pregnant?

The answer here is a resounding absolutely. Getting life insurance coverage during pregnancy is common.

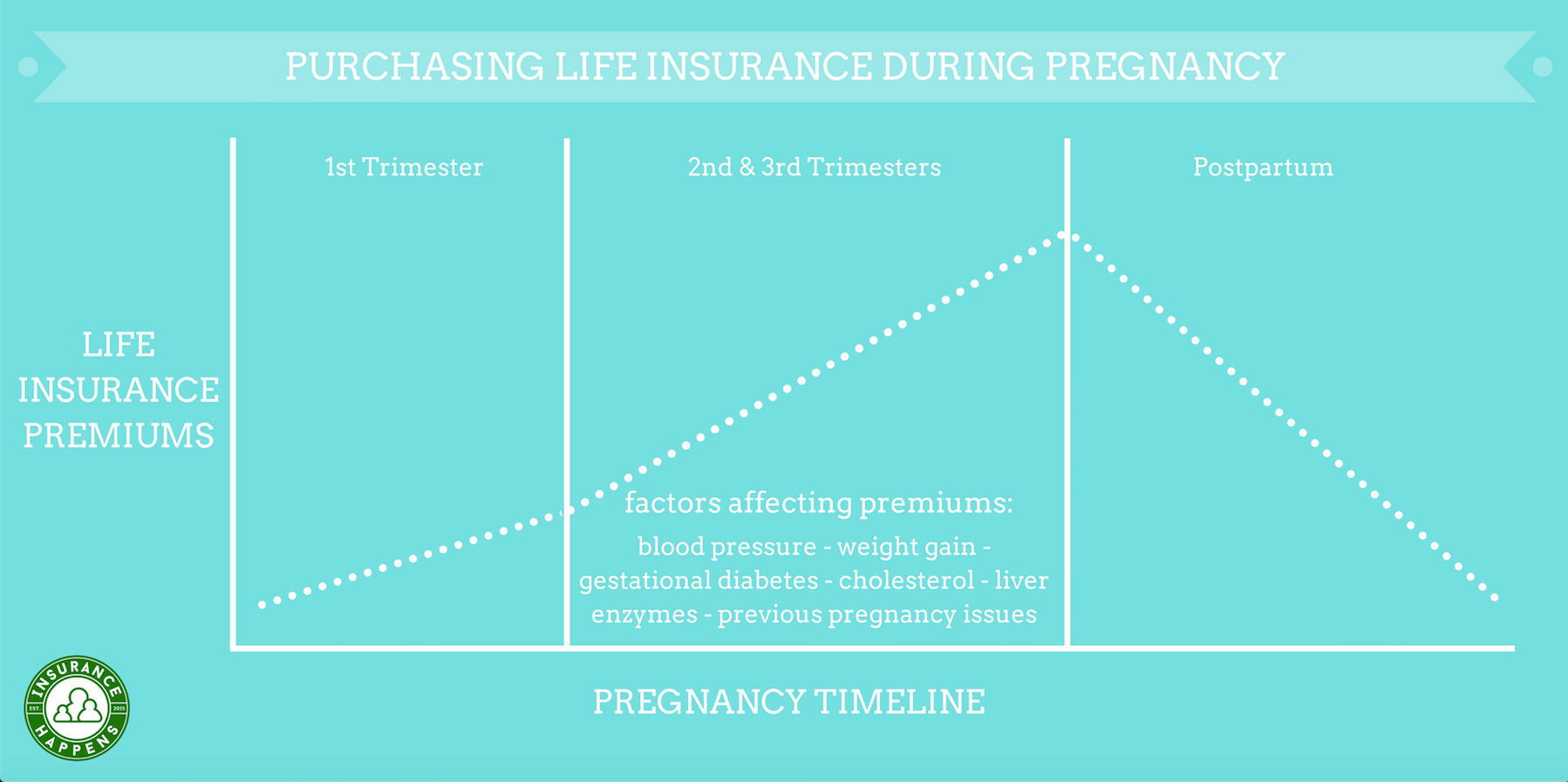

The sooner into your pregnancy you apply, the better. Commonly your life insurance premiums, which you pay either monthly or annually, will not be higher early into your pregnancy.

As a side note, life insurance exams do not conduct pregnancy tests. The medical examiner will ask if you are pregnant, and of course, you should always answer honestly.

Whether or not you are pregnant doesn’t affect your life insurance rating. Rather, it is the potential complications arising during pregnancy that could impact life insurance rates. (For more information, read our “What if I’m pregnant or planning to become pregnant? Will it affect the life insurance medical exam?“).

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

What if I have pregnancy complications?

What are some complications that could affect your life insurance rating? While pregnancy-related conditions can be stressful to think about, but it’s better to plan ahead rather than be surprised later in the pregnancy. Prenatal care is also important.

This is why considering life insurance during pregnancy can help alleviate some of that stress. Even if you are charged more during pregnancy for health concerns, some coverage is better than none when it comes to taking care of yourself and your family.

Remember, you can always reapply for coverage after your pregnancy if your premiums are elevated.

Common Health Complications During Pregnancy

Liver Enzymes

Your liver is an amazing organ in your body that performs a host of jobs, like removing toxins from your body, storing fuel for future use, and making proteins for your blood.

A liver enzyme test measures the chemicals secreted into the bloodstream by the liver, helping determine the health of your liver and how well it is functioning.

During pregnancy, an uncommon (1 in 1,000) condition called cholestasis can increase liver enzymes.

Life insurance companies consider an AST reading between 10 – 40 units per liter and an ALT reading to be between 7 – 56 units per liter to be within normal ranges.

Cholesterol

An important, waxy, fat-like substance found in all cells in your body. Cholesterol levels need to increase during pregnancy for the health of the baby.

However, if they rise too much, chronically elevated cholesterol levels are connected to cardiovascular conditions, including stroke.

Generally, insurance companies are looking for total cholesterol numbers to be under 200.

Blood Pressure

Essentially, blood pressure is the measurement of the pressure your blood puts against your blood vessel walls each time your heart contracts.

Elevated blood pressure is a common issue, affecting tens of millions of people. During the second half of your pregnancy, high blood pressure is called, gestational hypertension, and can cause complications such as preeclampsia, fetal growth restriction, and preterm birth.

Again, insurance companies are concerned with your test results, not if you’re pregnant or not. Usually, your blood pressure reading should be no higher than 140/90, without medication, for the lowest possible rates.

Gestational Diabetes

Pregnant women who have never had diabetes before, but have elevated blood sugar levels during pregnancy, are diagnosed with gestational diabetes.

If you’re of average risk for the condition, meaning that you have a BMI (body mass index) of below 30, no personal or family history of diabetes, and are younger than 25, your doctor will test you around week 24 of your pregnancy. Higher risk pregnancies will test earlier.

You’ll drink a syrupy glucose solution. One hour later, you’ll have a blood test to measure your blood sugar level. A blood sugar level below 130 to 140 milligrams per deciliter (mg/dL), or 7.2 to 7.8 millimoles per liter (mmol/L), is usually considered normal on a glucose challenge test, although this may vary by clinic or lab.

If your blood sugar level is higher than normal, it only means you have a higher risk of gestational diabetes. You’ll need a glucose tolerance test to determine if you have the condition.

Previous Pregnancy Complications

If you have been diagnosed with a condition such as gestational diabetes or hypertension during a previous pregnancy, insurance companies will factor that into your current rating.

Weight

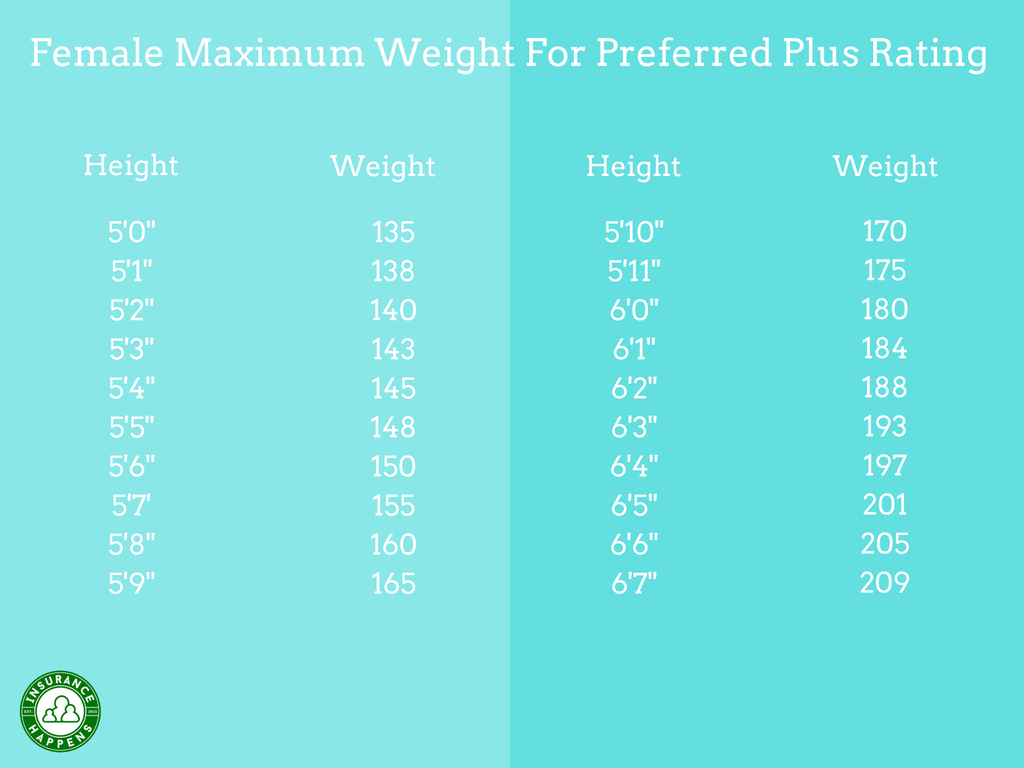

Life insurance companies assess your current weight to determine your rating (health class that sets your premium rates).

Because a high percentage of moms weigh more post-pregnancy than they did pre-pregnancy, they err on the side of caution and rate you at your present weight, regardless of pregnancy status.

Each life insurance company creates their own health class rating system, however, the general weight guideline below will help you understand the maximum weight females can weigh to qualify for a Preferred Plus (lowest premiums) rating.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

How much life insurance do I need?

Income replacement is a primary reason families decide to purchase life insurance.

A general rule of thumb is to multiply your annual income by 10 to determine the amount of life insurance to purchase.

For example, if you earn $60,000 each year, purchasing about $600,000 in life insurance likely makes sense.

Stay-at-home moms need life insurance, too. Even if you don’t earn money, and you stay at home with your children, salary.com estimates that a stay-at-home mom’s annual financial worth is over $100,000.

Think about the costs connected to what a mom accomplishes:

- Housekeeper

- Cook

- Daycare center

- Teacher

- Psychologist

- Janitor

- Interior designer

- Nurse

- Groundskeeper

Ultimately, it’s important that you decide on an amount you feel at peace with.

Keep in mind that life insurance proceeds can help cover a multitude of costs such as:

- Childcare

- Outstanding debt (mortgage, credit cards, student loans)

- College education for children

- Household needs (cooking, cleaning, yard work)

- Funeral costs

How does life insurance actually work?

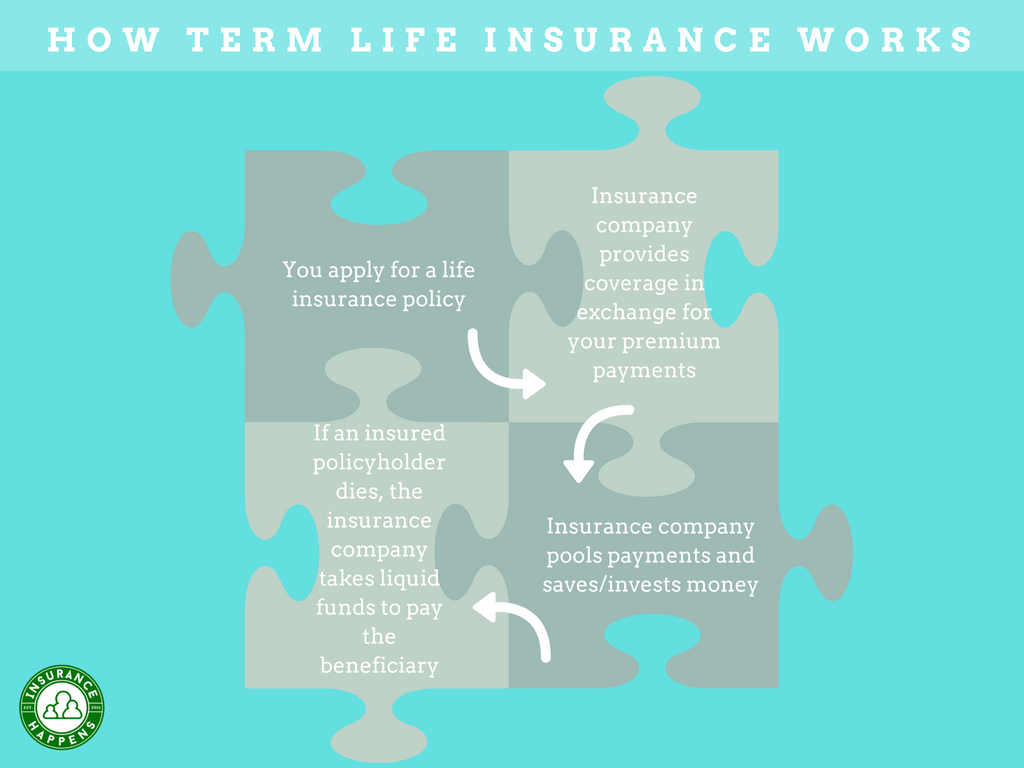

There are many types of life insurance. Generally, they all accomplish the same thing: if you should pass away, your life insurance policy will pay money to your loved ones (beneficiaries). It may not be the most positive perspective, but it is one that provides financial protection to your family, and is often looked at as a necessity.

Let’s focus on term.

Term life insurance pays a benefit in the event of the death of the insured for a specified period of time.

Policies are typically for periods of 10 – 30 years.

Highly affordable, term life insurance is straightforward and an excellent fit for most people who have loved ones depending on them.

The death benefit ends when the term ends, and the policy owner will then need to decide at that time whether or not they want to renew the policy.

What if I already have life insurance through my employer?

According to LIMRA, a worldwide research, learning, and development organization for financial services, approximately 70% of employees have access to life insurance through work.

This type of life insurance is called a Group Life Insurance Policy, since you and your coworkers carry a policy together, as a group.

While the coverage is usually paid for by your employer and is a nice employee benefit, you need to closely examine what the policy offers – and what it doesn’t.

First, the benefits are routinely guaranteed, the cost is typically free, and there’s no reason not to accept it. It’s possible you will have the option to purchase additional supplemental insurance through your employer. Often, you will need to fill out a health questionnaire to demonstrate “evidence of insurability” for supplemental.

Next, the benefits of group life insurance are usually limited. In fact, most policies provide about 1-2 times your annual salary. Even if you purchase the supplemental life insurance, you’re still limited to about 3-4 times your annual salary. Remember, at least 10 times your annual salary is generally recommended in coverage.

Lastly, your coverage stops if you leave your job.

Tying your life insurance to your job is risky. It’s possible you will have the option to convert your group life policy to an individual, but the cost (premiums) will likely go up drastically.

Your next employer may not offer group life insurance. And, if you wait to purchase life insurance until you don’t have coverage through an employer, you run the risk of a rate hike due to increased age and/or health complications.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Do both parents need life insurance?

The short answer is yes, both parents will need life insurance. (For more information, read our “Life Insurance for Parents (and How to Apply)“).

The long answer is yes, 99% of the time, and here’s why:

Life insurance protects your loved ones financially should something happen to you. If you are employed, it’s important to have a plan to replace your income.

However, life insurance is not just viewed as income replacement. Families should consider expenses. Even if you don’t work outside the house, your contributions to the family would be expensive to replace.

Peace of mind, financial stability and security should be the goal for both people in your partnership. Term life insurance policies are an excellent way to meet that goal.

The only exception to this rule would be if there would be no financial (or expense) impact if you or your partner died. Let’s say you have accrued a large enough financial buffer through savings, an inheritance or other sources to cover the cost of living for about 10 years.

In this case, you may not need life insurance for both parents. Obviously, most do not fall into this category.

I’m a single parent. Does that change my needs?

Yes. Life insurance becomes that much more important when you are your child’s one and only. Single parents are unsung heroes. You are taking on the responsibility that, typically, two people share.

Between helping with homework, cooking dinner and mowing the lawn, you’re guiding your children to emotional and physical well-being. Chances are, you are accomplishing all this while holding down a job.

Nearly four in 10 single parents have no life insurance, and many with coverage say they need more than they have. With so much responsibility resting on your shoulders, you need to make doubly sure that you have enough life insurance to safeguard your children’s financial future. – Life Happens, Who Needs Life Insurance?

Often, budgets are tight for a single parent. But, term life insurance is surprisingly affordable, even early into pregnancy. Age and health are the two biggest factors in determining the cost of term life insurance.

Consider this example:

Single Mom, 24 years old, healthy and 10 weeks pregnant. $500,000 of term life insurance for 20 years. Approximately $18/month.

How can I make sure I’m getting the best rates?

When shopping for life insurance, it’s important to work with an independent agent who is not held captive to a particular life insurance company.

That way, you can receive multiple quotes from multiple life insurance companies. You decide what company you want to apply with and the purchasing power is in your hands.

Depending on your health status, insurance company rates can vary greatly. To make an informed decision, you will want to be represented by someone who has access to multiple carriers.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Life Insurance Expert

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Life Insurance Expert

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.