Life Insurance for Parents (and How to Apply)

How do I get life insurance for my dad or mom? Choosing life insurance for parents is an important discussion to make. Follow our guide below on how to help your parents choose the best policy.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Life Insurance Expert

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Life Insurance Expert

UPDATED: Jun 26, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jun 26, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Most Americans believe in the need for life insurance.

- The beneficiary is the person(s), organization, school, church, or business receiving the death benefit from the life insurance policy

- The Goodman Triangle is when the owner, insured, and beneficiary are three different people.

You’re probably here because you’re wondering, “Can I buy life insurance for my parents?” Often, there’s a need for parents to have life insurance and they just haven’t taken the steps to look at life insurance quotes online and make a purchase. They’re not alone. Let’s learn how to get the best life insurance for parents.

Putting off purchasing life insurance happens all the time. Parents will tell us:

- I need to talk to my spouse or partner

- My budget won’t allow the purchase

- I just haven’t gotten around to it

- I don’t like to think about dying

You may be wondering if you can buy life insurance for your parents and help them take care of that need. The answer is: YES, you can.

Before we go in-depth on this, feel free to type your ZIP code into our free and helpful tool above to find life insurance rates for parents in your area.

Why is life insurance for parents important?

Consider the following statistics:

1. Most Americans believe in a need for life insurance.

Nearly 9 in 10 consumers (86 percent) agree that most people need life insurance. -LIMRA, Insurance Barometer Study

2. A gap exists between the financial needs of many Americans and how much life insurance they own – if any.

Two-thirds of Americans recognize they need life insurance, yet many do not have adequate coverage to protect their families. -LIMRA, Insurance Barometer Study

Understanding a need and taking action on that need are two entirely different things. Besides, understanding what type of life insurance you need and purchasing life insurance is about as fun as watching paint dry.

Totally understandable. Yet, securing life insurance is more affordable and straightforward than you think, and that peace of mind is priceless.

Here’s the truth – If someone would suffer financially should their parents die (including wrongful death, says Silver Law Offices), even an adult child, they need life insurance. A death in the family can completely change your financial situation and that’s something that most people are not prepared for.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

What do I need to know when buying life insurance for my dad or mom?

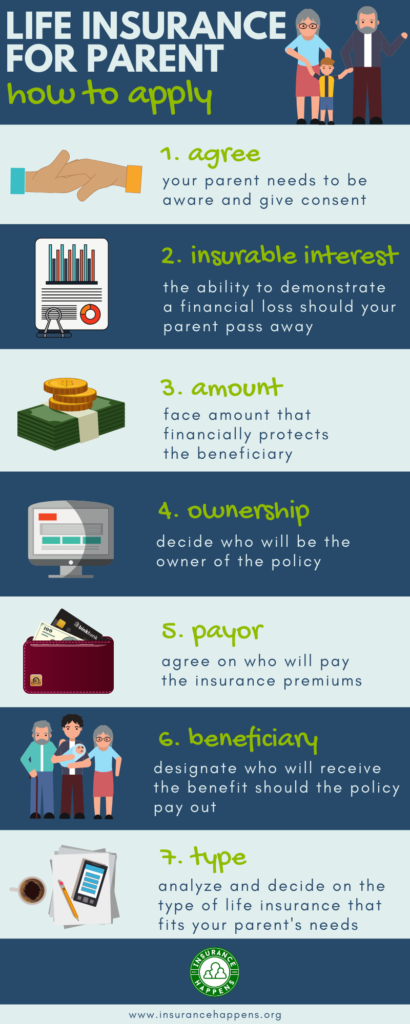

To begin, let’s focus on the seven essential facts you need to know about purchasing life insurance for your parents.

1. Do your parents agree to be covered?

In order to purchase life insurance for a parent, or on anyone for that matter, you must have consent.

It’s always necessary for your parent to agree to the life insurance policy. Think of consent as a way for life insurance carriers to protect against bad intentions someone might have.

Let’s move on to answer the question “can you get a policy for parents without their consent?”

Can I buy life insurance for my parents without consent?

Can I get life insurance for my mom without her knowing? Can I get life insurance for my dad without him knowing? In a word, no.

Just search online for, “foul play for life insurance” and you’ll see plenty of examples as to why consent is crucial. Dark, I know, but we are all aware that not everyone has good intentions.

Consent is always required.

*Note – an exception to this rule is if a parent is purchasing a life insurance policy on a minor child.

Key takeaway – In almost all cases, it’s considered unethical for a person to have life insurance taken out on them without their knowledge. Consent provides a safeguard and consent is required.

2. Can you prove that there is insurable interest?

Every state in the U.S. has insurable interest laws to protect the integrity of life insurance policies.

These generally state that the only people who can take out or hold an insurance policy on the life of another person are blood or legal relatives or those with a financial interest in the survival of the policy’s subject.

Here’s an example: Your mom is 72 and lives off her income from a small pension and social security.

She provides full-time childcare for your children. She doesn’t have a large amount of debt but has not saved up for funeral expenses or future medical bills that may occur.

Purchasing a modest policy (around $200,000) would likely make sense and would demonstrate an insurable interest.

Key takeaway – If you purchase a life insurance policy on someone (like your parent), you need to have an interest in their survival. Likewise, a financial burden would occur if they were to die.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

3. What would be an appropriate coverage amount?

Deciding on an amount of life insurance to purchase for your parent requires you to consider some important factors:

- Income

- Debt

- Mortgage

- Other expenses (i.e. medical bills)

- Funeral expenses

Let’s consider some examples of appropriate life insurance amounts:

Case Study #1

Your dad is 68 and owns his house. He lives off his firefighter pension. He carries a moderate amount of debt from the collectible cars he works on.

Your dad provides childcare for your family and helps around your house regularly. You decide to purchase a policy for $250,000 to cover debts, funeral expenses, and the financial loss you would incur in finding other childcare.

Case Study #2

Your mom is 78 and rents an apartment. She lives off of a modest social security payment. She does not carry debt.

However, your mom has not saved up money for final expenses. You decide to purchase a policy for $50,000 to cover her final medical bills and funeral expenses.

Case Study #3

Your mom is 62 and carries a mortgage of $300,000. She recently retired and lives off a pension and social security. In addition to her mortgage, she carries debt from her car, credit cards, and medical bills.

She does not have money in savings or investments. Your mom provides childcare for you three days a week.

You decide to purchase a $600,000 policy for her to pay for all debts and final expenses and to provide for future childcare needs.

Key takeaway – Life insurance carriers require you purchase an appropriate amount of coverage for your parent’s situation. Too much raises a red flag. Too little won’t provide the type of financial protection you need.

4. Who will have ownership of the policy?

The person (or sometimes entity) holding the rights to the life insurance contract. Ownership is important because he or she can make changes to the life insurance policy, such as:

- Beneficiary change

- Transfer of ownership

- Lowering the death benefit

- Adding or deleting riders

- Request a rating change for the insured

Important – While ownership of a policy may change, the insured may not change.

If the owner of the policy is also the insured, life insurance carriers will not ask clarifying questions.

If you are merely assisting your parent in securing life insurance, and they will own and make payments for the policy, this is a straightforward situation without the need for further considerations.

On the other hand, if you will be the owner of your parent’s life insurance policy, life insurance carriers will require you to provide proof of insurable interest.

In other words, you will need to demonstrate that you will experience a financial loss in the event of your parent dying. This is usually easy to do when you consider things like credit card debt, end-of-life expenses, child care costs, and other things like this that would impact your standard of living or financial situation.

Key takeaway – Ownership of the policy is straightforward if it will be owned and paid for by the insured: your parent. If you will be the owner of your parent’s life insurance policy, it’s crucial that it’s properly set up to protect you financially and insurable interest is established.

5. Who will be the payor?

The payor of a life insurance policy is who will be making the premium payments. The payor owns the contract and is often the insured of the life insurance policy. However, that’s not always the case. If you are purchasing a policy for a parent, for example, you are the payor and your parent is the insured.

Key takeaway – The individual or entity making the premium payments is the payor. The payor is considered the owner of the contract.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

6. Who will be the beneficiary?

The beneficiary is the person(s), organization, school, church, or business receiving the death benefit from the life insurance policy. Beneficiaries are usually loved ones, typically a spouse, who would experience a financial burden if the insured passed away. A lot of people choose to have their death benefit used to help cover their funeral arrangements, burial expenses, medical expenses, or similar things. It can also be used to establish trusts, cover continued living expenses if a mother or father still has a child to care for, leave an inheritance, and more. It all depends on the personal situation and financial resources that their loved ones will be left to deal with.

The policy owner will also have the ability to consider their payouts in another way. Will the money be delivered over a period of several years or months? Or, will they leave any heirs or dependents a lump sum of money?

But really, the sky’s the limit when choosing a life insurance beneficiary. In fact, your parents could list their beloved dog as a beneficiary if they wanted to.

Often, the life insurance beneficiary is:

- Spouse

- Child or children

- Small business

- School

- Church

When your parent is considering who to list as a beneficiary, these questions help:

- Who does your parent want to help financially?

- Would a person or a trust make more sense?

- What are the beneficiaries’ circumstances and would they benefit from life insurance proceeds?

- Is there a contingent beneficiary?

- Are any of the beneficiaries minors?

- Does my will match up with the life insurance policy proceeds?

- Will I use this life insurance payout to cover any estate taxes?

- Do I have any outstanding debt that should be covered with this money?

Key takeaway – Carefully choosing a beneficiary prevents future policy headaches. Be sure to work with an expert agent to guide you through the process.

7. What type of coverage is needed?

Life insurance comes in all sorts of types and sizes and there is a lot to consider. Is permanent life insurance a better option? Would a term life policy be a better fit? It’s also important to weigh the cost of life insurance against the life insurance benefits. There are a variety of life policies for parents, and it is important to compare the different types of policies and make sure that you’ll have the life insurance protection you need to fit their situations. There is a multitude of life insurance plans for parents. If you’d like a bit more detail read our article life insurance types explained.

Let’s look at the seven common types of life insurance policies that children purchase for their parents:

What is no exam life insurance for parents?

No exam life insurance is issued without your parent participating in a life insurance medical exam.

-

- Premium rates are often competitive with traditional fully-underwritten life insurance for healthy individuals.

- Policy face amounts available: $25,000 to over $1,000,000.

- The exact nonmedical life insurance application process varies by company. Depending on the carrier, no exam underwriting may include:

- Immediate accept/decline answer (considered simplified issue)

- Possible APS (Attending Physician’s Statement) order

- Request for the paramedical exam based on application or interview

- Some carriers have age limits or require an exam due to health or age. However, coverage is often offered up to age 80.

Note – most forms of life insurance are available without a required medical exam.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

What is term life insurance?

Term life insurance is traditional coverage, lasting for a certain number of years. Most providers will allow you to renew a term policy. Some will even allow you to convert that term policy to permanent life insurance after a specific period of time.

-

- Life insurance is offered for a specific term, typically between 10 – 30 years.

- Premium rates are affordable compared to other types of life insurance.

- Face amounts can range from $25,000 – over $1,000,000.

What is whole life insurance?

Whole life insurance lasts your whole life, as long as you make your premium payments. This is considered a permanent life policy.

-

- Benefits do not expire.

- It can be purchased with or without a paramedical exam.

- Face amounts available from $10,000 to over $1,000,000.

- Accumulates cash value.

- Premium rates are more expensive than term life.

What is final expense insurance?

Final expense life insurance is purchased to cover life’s final monetary needs, like burial costs. It is another type of permanent policy that can’t expire, but the funds typically can not be used in the same way a traditional death benefit would be used. This is usually viewed as a more affordable life insurance option.

-

- Considered a whole-life product, the benefits will not expire.

- Policies are typically capped at $50,000 – $100,000.

- No paramedical exam and approval can be instant, after completing a health questionnaire.

- It is often used to cover funeral expenses and final medical bills.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

What is guaranteed universal life insurance?

A guaranteed universal life insurance policy is a bridge between term and whole life insurance.

-

- Technically, a term product that is designed to last your entire life.

- Policies can last to over age 120.

- Face amounts available from $25,000 to over $1,000,000.

- Typically, it does not accumulate a cash value.

- Regularly purchased by parents to leave a legacy to loved ones.

What is universal life insurance?

Universal life insurance is a form of permanent coverage with a flexible policy design.

-

- Benefits do not expire.

- Typically affordable premiums.

- Face amounts available from $25,000 to over $1,000,000.

- Accumulates cash value.

- Usually, premiums and death benefits are adjustable.

Read more: How much does it cost to get a adjustable whole life insurance policy?

What is indexed universal life insurance?

Indexed universal life insurance is permanent coverage with cash value that is influenced by (but not directly invested in) stock market performance.

-

- Benefits do not expire.

- Face amounts available from $25,000 to over $1,000,0000.

- Cash value is directed to two subaccounts:

- Fixed

- Equity index

- The policyholder determines the amount of cash value directed towards each subaccount.

- Ideal for larger face amounts.

Key Takeaway – Understand the components of different types of life insurance policies in order to make an informed decision for your parent.

Note – Also consider survivorship life insurance in which both parents are protected under one policy.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Quotes for Life Insurance for Parents

Here, you will find a comprehensive list of sample rates:

- No Medical Exam

- Term

- Whole

- Final Expense

- Guaranteed Universal

We’re now going to take a look at a series of tables. Here are no exam term life insurance quotes for a male parent age 40-65.

No Exam Term Life Insurance Quotes For Parent: Males

| Age | $25,000 | $100,000 | $250,000 | $500,000 |

|---|---|---|---|---|

| 40 | $13.87 | $14.26 | $25.80 | $45.29 |

| 45 | $17.99 | $21.23 | $41.78 | $77.26 |

| 50 | $24.49 | $32.03 | $57.18 | $108.06 |

| 55 | $34.74 | $52.77 | $100.10 | $193.90 |

| 60 | $52.02 | $90.03 | $190.35 | $390.73 |

| 65 | $81.55 | $136.80 | $330.53 | $679.90 |

Here are no exam term life insurance quotes for a male parent age 70-80.

No Exam Term Life Insurance Quotes For Parent: Male

No Exam Term Life Insurance Quotes For Parent: Male| $25,000 | $100,000 | $250,000 | $500,000 | |

|---|---|---|---|---|

| 70 | $79.94 | $150.93 | $356.18 | NA |

| 75 | $139.91 | $254.25 | $613.58 | NA |

| 80 | $232.10 | $755.38 | NA | NA |

Here are no exam term life insurance quotes for a female parent age 40-65.

No Exam Term Life Insurance Quotes For Parent: Females

| Age | $25,000 | $100,000 | $250,000 | $500,000 |

|---|---|---|---|---|

| 40 | $12.28 | $12.18 | $20.88 | $35.46 |

| 45 | $15.47 | $16.61 | $32.06 | $57.82 |

| 50 | $20.00 | $23.52 | $48.73 | $91.16 |

| 55 | $27.53 | $36.66 | $80.66 | $155.02 |

| 60 | $43.21 | $59.40 | $136.35 | $270.18 |

| 65 | $65.39 | $92.47 | $218.01 | $429.72 |

Here are 20-year term life insurance quotes for a male parent age 40-65.

Term Life Insurance Quotes For Parents: Males

| Age | $25,000 | $100,000 | $250,000 | $500,000 |

|---|---|---|---|---|

| 40 | $8.39 | $10.89 | $17.80 | $28.74 |

| 45 | $10.75 | $15.58 | $27.95 | $48.64 |

| 50 | $14.86 | $20.74 | $40.85 | $74.51 |

| 55 | $21.74 | $29.93 | $63.43 | $118.41 |

| 60 | $34.27 | $49.61 | $110.03 | $204.94 |

| 65 | $57.28 | $88.99 | $208.57 | $394.69 |

Here are 20-year term life insurance quotes for a male parent age 70-80.

Term Life Insurance Quotes For Parent: Male

| $25,000 | $100,000 | $250,000 | $500,000 | |

|---|---|---|---|---|

| 70 | $68.28 | $79.36 | $178.06 | $319.34 |

| 75 | $115.93 | $133.79 | $325.28 | $644.44 |

| 80 | $208.29 | $243.60 | $599.81 | $1193.50 |

Here are 20-year term life insurance quotes for a female parent.

Term Life Insurance Quotes For Parents: Females

| Age | $25,000 | $100,000 | $250,000 | $500,000 |

|---|---|---|---|---|

| 40 | $7.42 | $10.33 | $15.44 | $25.25 |

| 45 | $9.18 | $12.78 | $22.75 | $38.47 |

| 50 | $12.28 | $16.45 | $30.90 | $54.87 |

| 55 | $17.59 | $22.49 | $47.03 | $85.49 |

| 60 | $28.10 | $36.87 | $77.82 | $138.51 |

| 65 | $46.81 | $62.04 | $135.95 | $255.63 |

Term Life Insurance Quotes For Parent: Female

| $25,000 | $100,000 | $250,000 | $500,000 | |

|---|---|---|---|---|

| 70 | $53.97 | $55.48 | $107.62 | $198.52 |

| 75 | $93.57 | $96.25 | $217.73 | $420.46 |

| 80 | $176.49 | $195.21 | $478.84 | $951.56 |

Here are whole life insurance quotes for a male parent.

Whole Life Insurance Quotes For Parent: Male

| $25,000 | $50,000 | $100,000 | $250,000 | |

|---|---|---|---|---|

| 40 | $40.08 | $73.85 | $134.41 | $326.33 |

| 45 | $48.15 | $89.99 | $164.41 | $401.58 |

| 50 | $58.36 | $110.43 | $203.53 | $499.36 |

| 55 | $72.34 | $138.38 | $255.50 | $629.30 |

| 60 | $89.97 | $173.64 | $324.71 | $802.33 |

| 65 | $115.08 | $223.87 | $416.64 | $1019.21 |

| 70 | $155.99 | $305.68 | $546.97 | $1359.38 |

| 75 | $219.48 | $406.13 | $738.11 | $1868.98 |

| 80 | $285.86 | $565.42 | $1097.07 | $2801.93 |

| 85 | $368.55 | $730.80 | $1455.30 | $3628.80 |

This table shows whole life insurance quotes for a female parent.

Whole Life Insurance Quotes For Parent: Female

| $25,000 | $50,000 | $100,000 | $250,000 | |

|---|---|---|---|---|

| 40 | $38.81 | $71.31 | $114.98 | $277.99 |

| 45 | $44.60 | $82.91 | $143.50 | $349.30 |

| 50 | $52.50 | $98.70 | $175.44 | $429.14 |

| 55 | $66.15 | $126.00 | $233.74 | $549.89 |

| 60 | $82.18 | $158.07 | $279.62 | $670.55 |

| 65 | $104.43 | $202.56 | $350.09 | $850.64 |

| 70 | $141.88 | $277.46 | $453.36 | $1117.30 |

| 75 | $193.31 | $362.64 | $614.22 | $1546.43 |

| 80 | $248.48 | $490.66 | $882.53 | $2277.66 |

| 85 | $302.03 | $597.76 | $1189.21 | $2963.58 |

Here are final expense quotes for a male, then a female, parent.

Final Expense Quotes For Parent: Male

| $5,000 | $10,000 | $25,000 | $50,000 | |

|---|---|---|---|---|

| 40 | $10.90 | $18.39 | $40.89 | $93.41 |

| 45 | $11.87 | $21.62 | $50.87 | $99.62 |

| 50 | $13.29 | $24.03 | $56.25 | $114.23 |

| 55 | $15.15 | $27.75 | $65.56 | $147.42 |

| 60 | $19.17 | $35.79 | $85.66 | $181.40 |

| 65 | $24.74 | $47.35 | $115.18 | $228.23 |

| 70 | $31.87 | $61.18 | $149.13 | $302.94 |

| 75 | $42.79 | $83.39 | $204.66 | $408.81 |

| 80 | $61.27 | $120.42 | $297.86 | $593.60 |

| 85 | $84.95 | $167.36 | $414.57 | $840.10 |

| 90 | $153.07 | $302.74 | NA | NA |

Final Expense Quotes For Parent: Female

| $5,000 | $10,000 | $25,000 | $50,000 | |

|---|---|---|---|---|

| 40 | $10.33 | $16.80 | $36.89 | $83.51 |

| 45 | $10.97 | $19.81 | $45.33 | $90.53 |

| 50 | $11.17 | $19.80 | $45.67 | $108.50 |

| 55 | $12.43 | $22.31 | $51.96 | $130.36 |

| 60 | $15.28 | $28.02 | $66.22 | $159.69 |

| 65 | $19.10 | $35.65 | $85.30 | $194.84 |

| 70 | $23.62 | $44.68 | $107.89 | $244.95 |

| 75 | $31.83 | $61.11 | $148.94 | $338.13 |

| 80 | $45.45 | $88.36 | $217.07 | $505.64 |

| 85 | $66.30 | $135.90 | $334.95 | $682.511 |

| 90 | $129.88 | $256.36 | NA | NA |

Finally, here are guaranteed universal life insurance quotes for a male, then a female, parent.

Guaranteed Universal Life Insurance Quotes For Parent: Male

| $50,000 | $100,000 | $250,000 | $500,000 | $1,000,000 | |

|---|---|---|---|---|---|

| 40 | $496.71 | $733.99 | $1592.50 | $3015.00 | $5690.00 |

| 45 | $559.10 | $848.19 | $1912.50 | $3590.00 | $6700.00 |

| 50 | $743.00 | $1105.00 | $2425.00 | $4570.00 | $8580.00 |

| 55 | $855.97 | $1331.00 | $2995.00 | $5775.00 | $11100.00 |

| 60 | $1174.33 | $1709.00 | $3905.00 | $7645.00 | $14950.00 |

| 65 | $1403.66 | $2272.00 | $5257.50 | $10180.00 | $19700.00 |

| 70 | $1997.08 | $3066.00 | $7172.50 | $13925.00 | $27000.00 |

| 75 | $2599.37 | $4115.00 | $9697.50 | $19230.00 | $38120.00 |

| 80 | $4079.05 | $6615.00 | $15652.50 | $30890.00 | $60940.00 |

| 85 | $5338.72 | $10626.15 | $26477.47 | $52841.18 | $105467.54 |

Guaranteed Universal Life Insurance Quotes For Parent: Female

| $50,000 | $100,000 | $250,000 | $500,000 | $1,000,000 | |

|---|---|---|---|---|---|

| 40 | $445.02 | $623.29 | $1332.50 | $2545.00 | $4840.00 |

| 45 | $502.36 | $729.73 | $1620.00 | $3029.74 | $5800.00 |

| 50 | $637.29 | $941.00 | $2050.00 | $3950.00 | $7590.00 |

| 55 | $732.39 | $1166.99 | $2640.00 | $5039.48 | $9710.00 |

| 60 | $1005.45 | $1499.00 | $3402.50 | $6610.00 | $12830.00 |

| 65 | $1177.72 | $1900.00 | $4375.00 | $8570.00 | $16780.00 |

| 70 | $1682.79 | $2619.00 | $6127.50 | $12015.00 | $23550.00 |

| 75 | $2159.23 | $3671.00 | $8655.00 | $17150.00 | $33980.00 |

| 80 | $3255.09 | $5583.00 | $13225.00 | $25780.00 | $50200.00 |

| 85 | $4198.02 | $8353.93 | $20.771.44 | $41520.82 | $82828.65 |

Note – universal and indexed universal life insurance are advanced insurance products. Speak to an independent agent about quotes.

How can I choose the best life insurance for my mom or dad?

Every parent has unique life insurance needs and considerations. Here are the top five considerations for you to analyze.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

How do you budget for life insurance for parents?

How much money can I put towards a policy?

You will only want to purchase a policy for your parent that makes sense for your finances. For most, affordability is paramount.

There are a number of factors that influence the cost of a policy, including:

- Face Amount

- Term vs Whole

- Age

- Gender

- Health

- Tobacco use

- Lifestyle

In the process of purchasing life insurance for your parents, it’s ideal to secure coverage for:

- an adequate amount

- an appropriate length of time

However, we can only afford what we can afford. And for many of us, it’s stretching our budget to buy life insurance for a parent.

Is it possible to find cheap life insurance for parents?

Is there cheap life insurance available? Yes.

Your parent’s age, health, and desired policy type will affect premiums.

Not all life insurance costs are the same.

Consider the cheapest forms of coverage by comparing quotes:

Let’s take a look at quotes for a 65-year-old male.

$50,000 Life Insurance For 65 Year Old Male

| Policy Type | Monthly Premium |

|---|---|

| 10 Year Term | $38.85 |

| 20 Year Term | $167.87 |

| Guaranteed Universal | $174.24 |

| Whole | $240.23 |

Now, here are quotes for a 65-year-old female.

$50,000 Life Insurance For 65 Year Old Female

| Policy Type | Monthly Premium |

|---|---|

| 10 Year Term | $29.83 |

| 20 Year Term | $147.25 |

| Guaranteed Universal | $154.44 |

| Whole | $217.57 |

Keep in mind – your parent must qualify for the specific type of policy.

Can I get life insurance for an elderly parent?

Does my parent’s age affect the type of policy I can buy?

Your parent’s age plays a primary role in the type of life insurance you should look at.

Younger applicants will have the most options. As your parent ages, so do their choices for coverage.

What if my parent is elderly?

And, just what age designates someone as elderly, anyway?

For your parent, chances are, it’s some particular number that’s more than their age.

Life insurance carriers, on the other hand, do have age cutoffs for their products. Fortunately, it’s possible to find a policy for elderly parents.

Let’s take a look at typical age cutoffs for different products:

- Term – age 80

- Guaranteed Universal – age 85

- Whole – age 85

- Final Expense – age 90

Key Takeaway – Elderly parents buy life insurance all the time, typically up to age 90.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Can I get life insurance for a sick parent?

What if my parent has health complications?

Your parent’s health, or lack of it, plays a major role in deciding which form of coverage to buy.

For healthy parents, especially if they are 80 years old or younger, the best life insurance companies will usually offer all forms of coverage. However, if serious health conditions exist, policy options often change.

Sick parents are frequently still able to buy coverage. Your parent’s specific illness matters. Health conditions are all underwritten differently.

Yet, thankfully, life insurance approval – even if your parent is sick – can happen.

Common health issues that typically won’t prevent your parent from being approved for a policy:

- Diabetes

- Heart disease

- Overweight

- Hypertension

- Cancer

- Arthritis

Keep in mind – you may need to look at final expense or guaranteed issue life insurance if your parent is seriously ill.

Life Insurance For Terminally Ill Parent

If your parent has been diagnosed with a terminal illness, there is one specific type of policy they can qualify for: guaranteed issue.

We only recommend guaranteed issue life insurance when your parent doesn’t qualify for other forms of coverage.

Often, if your parent’s doctor utters the words, “terminally ill”, it prompts you and your family to get affairs in order – including life insurance. Guaranteed issue is a godsend for those circumstances.

Most important features of guaranteed issue:

- Modest policy size

- No medical exam

- No health questions

- Form of permanent life insurance

- The death benefit is graded

Can I find no exam life insurance for my mother or father?

Can my parent skip the medical exam?

No medical exam life insurance for parents is requested all the time.

For many, there is no interest in being poked and prodded during the application process:

- Medical environments make your parent cringe

- The thought of the paramedical exam prevents your parent from applying

- Your parent would rather skip the inconvenience

- You’d prefer to secure a policy now, rather than waiting weeks for medical underwriting

Fortunately, just about all different types of life insurance have policies available without a required physical. And, some types of life insurance never require a physical exam – final expense and guaranteed issue.

How should I compare life insurance plans for my parent?

How should I compare the different policies in relation to my parent’s needs?

Before applying for a policy for your parent, it’s worthwhile to understand a number of things:

- What is my (or my parent’s) budget?

- What are my parent’s financial needs?

- How long will my parent’s financial needs last?

- What type of policy does my parent qualify for? (age and health are major factors)

Also, know that each life insurance company is different in its products, premiums, and riders. Be sure to know your options and compare premium pricing with an independent agent, first.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Life Insurance for Parents: The Bottom Line

People buy life insurance for their parents all the time.

If your parents agree to the policy, it’s legal and can be a smart investment in your family’s future. You do, however, need to set the policy up carefully to avoid tax implications.

To review, here are the four main parties to a life insurance contract:

Owner

The person (or sometimes entity) that holds all the rights to the life insurance policy. The owner is who can make changes to the policy. They are ultimately responsible for the purchase of the contract.

Insured

The person whose life is insured by the policy. Often, the owner and the insured are the same people. If the owner is not the insured, life insurance companies will ask for you to demonstrate an insurable interest (see #2).

Beneficiary

The person(s) who will receive the death benefit upon the death of the insured. In the case of your parent, the beneficiary is often the child (or children) of the parent.

Insurer

The life insurance carrier that is providing the life insurance contract.

WARNING – It’s crucial that the policy is set up appropriately. There is the possibility of falling into a tax trap if your parent’s life insurance policy is not handled carefully.

Life insurance proceeds are usually tax-free, except when the owner, insured and beneficiary are three different people.

This is known as the Goodman Triangle.

An example of how the Goodman Triangle can happen

- A son owns a life insurance policy on his mom. The son’s daughter is named as the beneficiary. For tax purposes, the policy proceeds are viewed as a gift to his daughter and would be taxed accordingly. The son would be taxed on the “gift” he provided his daughter.

How to avoid the Goodman Triangle

- In most cases, it can be avoided by having two “points of the triangle” be the same person.

- In the example above, if the son’s mom was both the owner and the insured of the policy, there would no Goodman Triangle.

Key Takeaway – Use caution when setting up your policy and understand how to avoid the Goodman Triangle. Don’t have the owner, insured and beneficiary be three different people.

Applying for Life Insurance for Parents: How should I get started?

Yes, you can purchase life insurance for your parents or any other consenting adults. This policy can be applied to cover things like final costs, medical bills, or estate taxes after they pass away.

The most important first step to take is to collaborate with an independent life insurance agent.

An independent agent represents multiple carriers to provide multiple life insurance quotes.

Your best interests are at heart, and you are not held captive to a particular life insurance carrier. That way, your parents will receive the highest quality policy at the most competitive price they qualify for.

Get a start on finding life insurance for your parent by typing your ZIP code into our free and helpful tool below to find affordable life insurance quotes for parents in your area.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Life Insurance Expert

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Life Insurance Expert

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.