Getting Life Insurance After Lyme Disease Diagnosis

Lyme disease is the most common tick-borne infectious disease in the United States. Getting life insurance after Lyme disease diagnosis will involve life insurance carriers asking questions and assessing how much risk you pose. "I can get life insurance with Lyme disease" is the mentality to have even if you’ve been declined life insurance in the past.

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 4, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 4, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Lyme disease, or borreliosis, is the most common tick-borne infectious disease in the United States.

What you can do: Understanding Lyme disease, and how a life insurance carrier thinks about Lyme disease, is essential to making a wise decision when purchasing life insurance.

Let’s get started:

Lyme Disease Overview

Life Insurance With Lyme Disease

Apply For Life Insurance

Lyme Disease Overview

Lyme disease is on the rise.

Stories are popping up all over the nation about increases in deer ticks and Lyme disease. Consider this one:

In Woodland Park, New Jersey, there was an abundance of acorns produced a couple of years ago. The acorns led to a boom in the population of little white-footed mice.

Guess who loves to munch on these mice? Yep – ticks. The Lyme-carrying variety, especially.

The most common infected tick in New Jersey — black-legged or deer ticks — will feed on just about any animal they can attach themselves to. And although they are often found on deer, which can transport them around a forest, it’s typically the white-footed mouse that infects ticks. The mice host the bacteria that causes Lyme disease, borrelia burgdorferi. Ticks acquire them by feeding on mouse blood and can then transmit them to other animals and humans. – Why 2017 may be a very bad year for Lyme disease, USA Today

Who gets it?

According to the Mayo Clinic, there are around 300,000 new cases of Lyme disease diagnosed annually. Although, many experts believe the actual number to be much higher.

Lyme disease is most common in the northeast and Midwest. In fact, 95% of diagnosed cases come from 14 states:

- Connecticut

- Deleware

- Maryland

- Maine

- Massachusetts

- Minnesota

- New Hampshire

- New Jersey

- New York

- Pennsylvania

- Rhode Island

- Vermont

- Virginia

- Wisconsin

Read more:

- Getting Life Insurance in Virginia

- Getting Life Insurance in Rhode Island

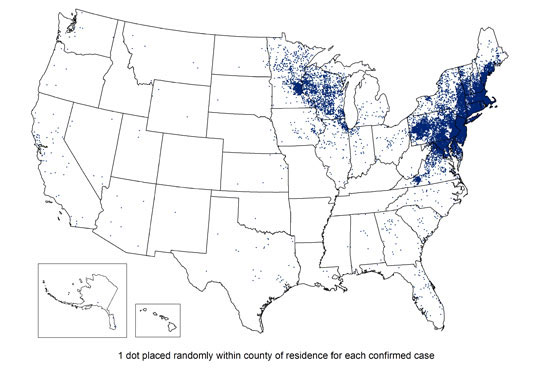

Lyme disease occurs nationwide, however. This Centers for Disease Control and Prevention map displays the United States Lyme disease infections for 2015, the most recent year mapped:

How Do You Get It?

In the United States, Lyme disease is caused by the Borrelia burgdorferi and Borrelia mayonii bacterias. Black-legged deer ticks are carriers of these bacteria.

To contract Lyme disease, an infected deer tick must bite you and typically remain attached for 36-48 hours. Because they are very small, often no larger than a poppy-seed, it can be easy to miss them.

If you find an attached tick that looks swollen, it may have had enough time to transmit the bacteria. Tick removal should happen as soon as possible.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Early Signs And Symptoms

Signs and symptoms of Lyme during the early stages can be somewhat vague and flu-like:

- Fever

- Chills

- Muscle and joint aches

- Swollen lymph nodes

However, in approximately 80% of cases, there’s a hallmark symptom:

- Erythema migrans – a circular red rash resembling a bulls-eye

Later Signs And Symptoms

If left untreated, Lyme disease is oftentimes debilitating. Not all individuals experience every symptom:

- Severe headaches

- Joint Pain

- Facial palsy

- Nerve pain

- Heart disease

- Inflammation of the brain and spinal cord

- Eye inflammation

- Liver inflammation

- Numbness in hands and feet

- Short-term memory loss

- Depression and anxiety

- Kidney disease

Treatment

Early-stage Lyme disease is straightforward: antibiotics.

Usually, oral antibiotics is considered standard treatment for early Lyme disease. A 14-21 day course of amoxicillin or cefuroxime for adults or children over 8 years often effectively treats Lyme disease, although some doctors find 10-14 days of antibiotics as equally effective.

If the disease has affected the nervous system, intravenous antibiotics are regularly prescribed. Treatment can last 14-28 days.

Chronic Lyme disease (PTLDS) treatment is more complicated.

The Mayo Clinic states, in reference to chronic Lyme disease:

The cause of these continuing symptoms, known as post-treatment Lyme disease syndrome, is unknown, and treating with more antibiotics doesn’t help. Some experts believe that certain people who get Lyme disease are predisposed to develop an autoimmune response that contributes to their symptoms. More research is needed.

For someone experiencing chronic symptoms, the current state of understanding in the medical community is not reassuring. In fact, the documentary, Under Our Skin, does a poignant job of describing just how frustrating the situation is.

It’s clear that those directly impacted by chronic Lyme disease are unhappy with the recommendations from the medical community.

It boils down to one simple fact. The federal agency charged with protecting the nation’s health continues to work against the interests of citizens unlucky enough to be nailed by a Lyme-infected tick.

Currently, physicians recommend the following for chronic Lyme disease:

- Education

- Support group

- Symptom tracking and treatment as needed

- Collaboration with physician

The use of complementary, alternative therapies such as essential oils may be promising. However, additional vivo work is needed to address safety and pharmacokinetic properties.

Life Insurance With Lyme Disease

Purchasing life insurance with Lyme disease is a common request life insurance carriers receive.

A quick search of Lyme disease public forums discussing life insurance shows you’re not alone:

Hi everybody – I was wondering if anyone with chronic Lyme has had any luck getting life insurance. I’ve been dinged by a couple of carriers, and I am starting to wonder if it’s a non-starter. – Greg, Seattle, WA, Health boards, Lyme Disease Forum

My husband was turned down for life insurance because of a Lyme dx. Otherwise, he’s 31, incredibly fit, non-smoker, blah blah blah. Perfect candidate. Since he was still in treatment for Lyme, however, he was denied. – Anna, LymeNet, Lyme Disease Network

I tried to get life insurance, but the company has postponed giving me a policy until I have finished treatment and my doctor has stated that my Lyme disease is in remission. I knew my situation wasn’t good, but somehow having a corporation state it in so many words is just a bit upsetting. – Achieving Grace, Healing Well, Lyme Disease Forum

Confusion tops the list of how people feel about purchasing life insurance with Lyme disease. That’s understandable.

Just like the disease itself is perplexing, underwriting (the process the life insurance carrier undertakes to assess one’s risk and charge them for life insurance) Lyme disease is often complicated.

Grab a pencil and be prepared to answer the following when applying for life insurance:

Life insurance carriers think of applications in terms of data. While it may sound impersonal, their job is to assess how much risk you pose and charge you accordingly.

Specific to Lyme disease, the following will help them understand your risk:

- Date of Diagnosis – How long you have had Lyme disease will impact the side effects you may experience.

- Duration of Treatment – Underwriters will want to know how long you were treated for Lyme disease. The longer your treatment plan, the more potential negative side effects you experienced.

- Resolved? – This is a big one for Lyme disease. Carriers are interested in whether your Lyme disease has been resolved. They will also want proof from your physician that your Lyme disease has been effectively treated. Effective treatment helps your application substantially.

- Chronic PTLDS? – Do you experience chronic post-treatment Lyme disease syndrome? Unresolved chronic symptoms negatively impact your life insurance application.

- Current treatment? – Are you currently being treated for Lyme disease? If so, what kind of medication, dosage, and how often do you take the medication? Underwriters will look at specific medications for potential negative side effects.

Bottom line – while it may seem overwhelming to assess how life insurance carriers view Lyme disease, it’s worth it. There are always life insurance options available to you, regardless of how severe your Lyme disease is.

Apply For Life Insurance

Purchasing life insurance with Lyme disease is possible. The type and size of policy you qualify for are dependent on the severity of your Lyme disease and whether it has been resolved.

Remember – financially protecting your loved ones is the right thing to do. We’ll help you find coverage you can qualify for, even if you’ve been declined life insurance in the past.

The most important first step to take is to collaborate with an independent life insurance agent. An independent agent represents multiple carriers to provide multiple quotes.

Your best interests are at heart, and they are not held captive to a particular life insurance carrier. That way, you will receive the highest quality policy at the most competitive price you qualify for.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.