7 Things You Need To Know About Life Insurance For A Child

Purchasing a life insurance policy is one way to provide safety now and opportunity in the future, but you may be having difficulties finding what is the best life insurance for a child. If you have wondered "How much life insurance do I need with kids?" then we can assist. There are 7 things you need to know about life insurance for a child when considering a life insurance policy.

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

There’s a children’s story, “Guess How Much I Love You“, written by Sam McBratney:

It’s a sweet simple tale in which Big Nutbrown Hare and Little Nutbrown Hare describe how much they love each other.

Really, their love for one another is boundless. Their descriptions for how to quantify their love keep growing because it’s hard to put into words just how much love they have.

So it goes with the love we have for our children. It’s immeasurable.

We want the best for them and to keep them safe, always.

Making the decision to purchase a life insurance policy for your child is one way to provide safety now and opportunity in the future.

In fact, it’s quite common for parents (and grandparents) to buy policies for their children or grandchildren.

Quick Nav

Life Insurance On A Child? Let’s talk about it.

There are seven things you need to know before purchasing a life insurance policy for a child:

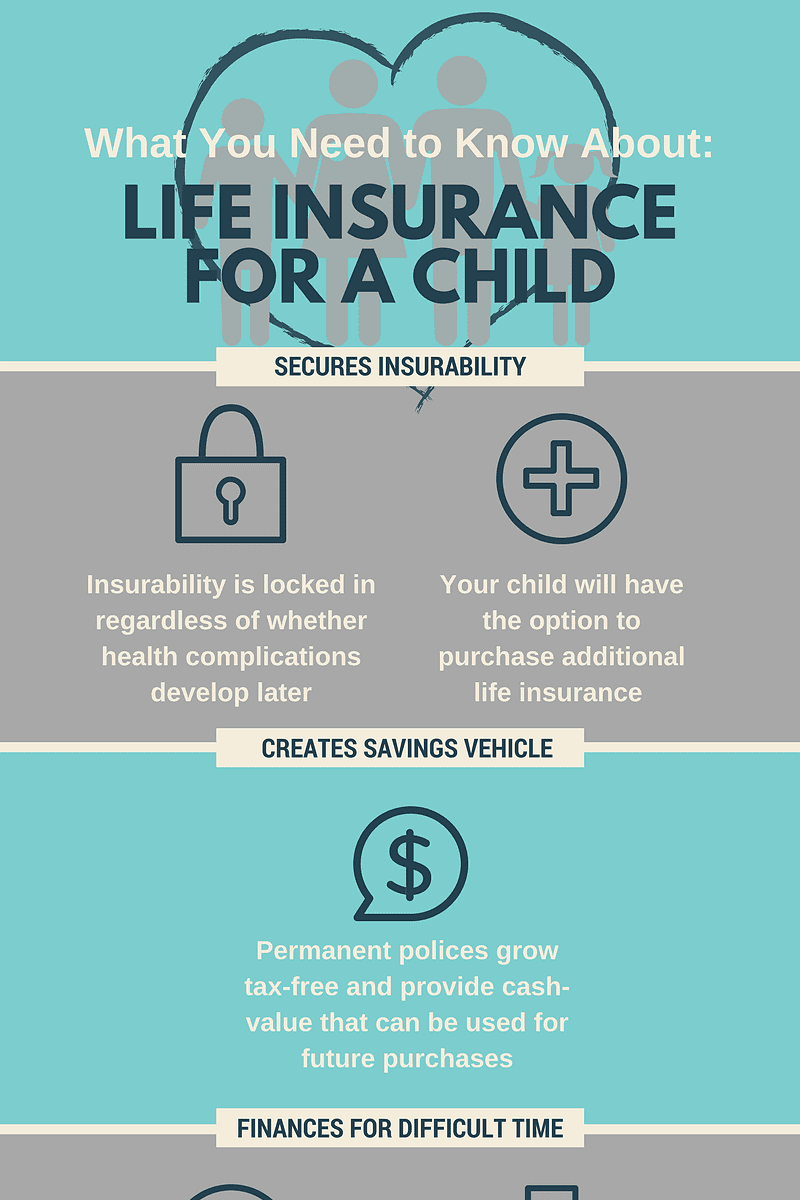

Insurability Is Locked In

If you purchase life insurance for your child, you essentially secure their insurability.

Even if they were to develop health complications later on in life. Serious medical conditions that would typically interfere with qualifying for life insurance – don’t. Their existing coverage safeguards them.

Why it’s a good idea: Protecting your child’s insurability is a primary reason life insurance is purchased for a child. By locking in a low-rate, you are guaranteeing their ability to have lifelong financial protection through life insurance.

Insurability is easy to take for granted when you have it. – Erica Oh Nataren, Life Happens, A Nonprofit Organization

Reason against it: The odds of your child developing a serious illness are very slim.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Option To Purchase Additional Life Insurance

Securing a modest amount of life insurance for your child now grants them the opportunity to purchase more coverage in the future. Let’s consider an example:

- You purchase a permanent life insurance policy of $50,000 for your three year old daughter. You pay around $30/month.

- When your daughter turns 21, she decides to increase her policy to $500,000 and has a low rate already locked in.

45% of those who purchase juvenile life insurance do so to lock in a low rate. 20% of those asked had purchased a life insurance policy on their child or grandchild. -LIMRA, Life Insurance and Market Research Association, 2015 Insurance Barometer Study

Savings Vehicle

Permanent (whole) life insurance policies include a cash-value component.

In other words, the policy accumulates (tax-advantaged) money. Permanent policies guarantee a certain percentage of return on the cash-value in your policy. You have the ability to borrow against* the money and use it for just about anything:

- Car loan

- Down payment on home

- Small business loan

- Personal loan

- College expenses

*You may face policy fees if you surrender the policy.

Policy Gives You Time

While it’s unfathomable to think about, should the death of a child occur, a life insurance policy would give you time. By replacing your income for a period, you are able to stay home and focus on the needs of your family.

Often described by psychologists as the greatest emotional heartache one can experience, a parent faces deep turmoil after the loss of a child. The US National Institutes for Health chronicle:

- Depression

- Martial disruption

- Cardiovascular disease

- Emotional distress

Income replacement during a tragedy is invaluable.

Policy Provides Finances

In the event of the death of a child, a policy can pay for:

- Funeral expenses

- Medical bills

- Family counseling

- Time off from work

Option 1: Policy For Your Child

You can purchase a permanent (whole life) policy covering your child. Most of the major life insurance companies offer this type of life insurance.

What to know:

- Policies are typically purchased for modest amounts

- They provide lifelong coverage

- Policy amount can be increased later on

- Premiums are more expensive than term life insurance

- Your child is underwritten without a medical exam

- Policies provide a cash-value

- Policies will likely be declined if your child has a history of cancer, heart disease, epilepsy, serious disease or disorder

A permanent policy, especially one with a guaranteed policy purchase option for additional insurance in the future, provides protection for life, regardless of how the child’s health status may change. – Jaimee Niles, Life Happens, VP of Communications

Option 2: Child Rider On Your Policy

Alternatively, you can add a child rider onto your life insurance policy. A child rider is an optional provision you can add to your life insurance that would extend coverage to your child.

What to know:

- A child rider extends life insurance coverage to your child

- You determine the dollar amount of the rider for your child

- Your child does not need a medical exam

- You may have the option to convert the rider to a whole life policy for your child

- Riders will likely be declined if your child has a history of cancer, heart disease, epilepsy, serious disease or disorder

Read more: Can you get life insurance when you have epilepsy?

How Much Does Life Insurance For A Child Cost?

For a general idea of cost, consider the sample child life insurance quotes. The exact cost will vary by carrier.

Keep in mind, rates are the same regardless of gender.

Child Life Insurance Quotes

| Age | $10,000 | $25,000 | $50,000 | $100,000 |

|---|---|---|---|---|

| Newborn | $10 | $17 | $29 | $43 |

| 1 Year Old | $10 | $17 | $29 | $43 |

| 2 Year Old | $11 | $18 | $30 | $44 |

| 3 Year Old | $11 | $19 | $32 | $45 |

| 4 Year Old | $11 | $20 | $34 | $46 |

| 5 Year Old | $11 | $20 | $34 | $47 |

| 6 Year Old | $12 | $20 | $35 | $49 |

| 7 Year Old | $12 | $21 | $36 | $50 |

| 8 Year Old | $12 | $21 | $36 | $52 |

| 9 Year Old | $12 | $21 | $37 | $53 |

| 10 Year Old | $12 | $22 | $38 | $56 |

| 11 Year Old | $12 | $22 | $39 | $58 |

| 12 Year Old | $13 | $23 | $40 | $62 |

| 13 Year Old | $13 | $24 | $42 | $65 |

| 14 Year Old | $13 | $24 | $43 | $68 |

| 15 Year Old | $13 | $25 | $44 | $72 |

| 16 Year Old | $14 | $25 | $46 | $73 |

| 17 year Old | $14 | $25 | $47 | $74 |

Note – typically, your child needs to be at least 14 days old to purchase coverage.

Read more:

- How much life insurance coverage does a 16-year-old need?

- How much life insurance coverage does a 17-year-old need?

Best Life Insurance Companies For Child

It’s a good idea to compare and contrast before applying for coverage for your child. Each carrier’s policy details are different.

Consider the following two life insurance companies.

Mutual Of Omaha

Mutual of Omaha’s Children’s Whole Life insurance is competitively priced and one of the best products on the market.

Financial rating: A+ (A.M. Best)

Product name: Children’s Whole Life

Age range: 14 days – 17 years

Face amounts: $5,000 – $50,000

Underwriting: a couple of health questions

Cash value: yes

Gerber

Gerber offers the Grow-Up Plan, another popular life insurance product for children. At age 18, the coverage amount doubles.

Financial rating: A (A.M. Best)

Product name: Grow-Up Plan

Age range: 14 days – 14 years

Face amounts: $5,000 – $50,000

Underwriting: four health questions

Cash value: yes

Frequently Asked Questions

Questions about juvenile life insurance and their answers.

Should I buy life insurance for my child?

It is entirely up to you.

Because of the personal nature of the decision, we recommend asking yourself a few important questions.

- Is there a family history of illness that could potentially hinder my child’s future insurability?

- Will I have peace of mind knowing my child has lifelong life insurance protection?

- Do I realize that, in all likelihood, the life insurance will never be needed (thankfully) and that other savings vehicles exist?

Is there a medical exam?

No.

Children’s life insurance is always a form of no exam life insurance. That means, no nurses, no needles, and no liquid samples.

In fact, you can purchase a policy entirely online.

Who can buy life insurance for a child?

Not just anyone can buy a life insurance policy for a juvenile.

Why? Measures are in place to safeguard the integrity and purpose of life insurance – financial protection. You must demonstrate that you would experience a loss should the unthinkable happen.

Usually, biological parents, step-parents, adoptive parents, grandparents, and legal guardians are allowed to buy a life insurance policy for a child.

What happens to the policy when my child turns 18?

Your child may keep the policy, with their insurability intact. They can also opt to add additional coverage.

Further, the cash-value is often utilized to help fund major purchases, like a car or house.

Will the premiums increase?

No.

Your child’s life insurance policy includes level premiums.

If down the road, your child chooses to add more coverage, the premiums will reflect the new face amount.

Can I buy term life insurance for my child?

No.

All life insurance policies for juveniles are permanent.

Bottom Line

Purchasing life insurance for your child absolutely has its merits. You are providing the opportunity for lifelong financial protection, regardless of possible health complications in the future.

Additionally, if you purchase a permanent policy for your child, they can tap into the savings and cash-value the policy provides.

It’s something we can easily afford, and it’s something we know will have value for them no matter what happens in life. – Trent Hamm, The Simple Dollar

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.