What is Hematuria and How it Changes Life Insurance

Hematuria is a medical issue caused when your kidneys allow trace amounts of blood into your urine. When underwriting hematuria for life insurance, depending on the state of your overall health, there should not be a substandard rating. If you're considering insurance, you should know what is hematuria and how it changes life insurance.

Read more

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

UPDATED: Mar 16, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 16, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from top life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Many aspects of your health are taken into consideration when you are applying for medically-underwritten life insurance.

Most, like your weight, diet smoker’s status and the amount of physical activity you engage in, can be managed.

But what if we told you that some medical issues may not even be discovered until the time of your life insurance exam?

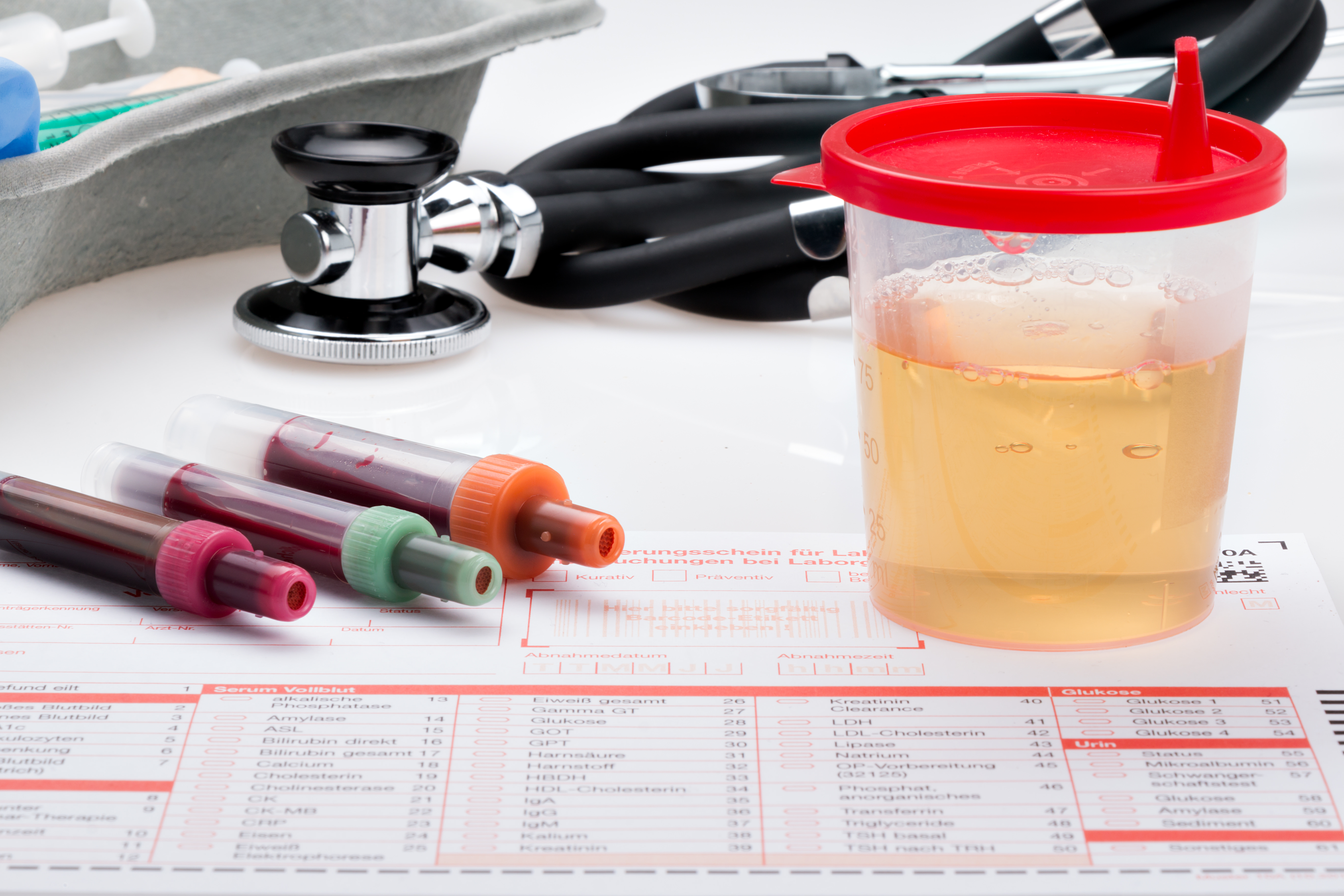

Hematuria, or blood in the urine, is a medical issue that is often not discovered until a medical exam. Hematuria is caused when your kidneys – or other parts of your urinary tract – allow trace amounts of blood into your urine.

You may be thinking that if there were blood in your urine, you would know it; however, hematuria is often characterized by trace amounts of blood in the system, which are not visible to the unaided eye.

Typically, a microscopic study or a dipstick is used to determine how much blood is in the urine.

The problem with hematuria is that it can be caused by almost any disorder of the urinary tract, which means that the presence of blood in the urine cannot be traced to one particular cause.

Additional tests must be run in order to trace the source.

For healthcare professionals, underwriters and applicants alike this poses a time-consuming problem.

Let’s talk about some of the potential cases of hematuria and what these might mean for your life insurance premium.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

What is Hematuria and What are the Causes

The causes of hematuria widely vary, from the innocuous to the downright scary.

Urinary tract infections, or UTIs (sometimes known as cystitis, which refers to the kidney, bladder, and urinary tract infections), are perhaps the most common causes of hematuria.UTIs occur when bacteria enter your body through your urethra and multiplies in your bladder.

Treatment for UTIs includes drinking plenty of water and taking antibiotics.

Kidney infections, bladder stones or kidney stones can also cause hematuria. Kidney infections are similar to UTIs and are also treated with antibiotics. Kidney or bladder stones are treated by anti-inflammatories or an increase in liquid intake.

Often, these are too small to notice unless they cause a blockage or are being passed.

Urethritis is another common cause of blood in the urine. This bacterial infection occurs when the urethra is inflamed and is commonly caused by a sexually transmitted infection. Like cystitis, urethritis is treatable by taking antibiotics.

Another mild cause of hematuria is an enlarged prostate. The prostate gland is located just below the bladder and surrounds the urethra.

As men age, it begins growing and may press on the urethra, partially blocking urine flow.

The treatment for this is usually to watch-and-wait, as occasionally an enlarged prostate can be a sign of prostate cancer.

To insurance underwriters, the above aren’t necessarily cause for alarm. In some cases, there are health-threatening causes of hematuria, which immediately increase an applicant’s risk.

If the levels of blood that are discovered in your urine are significant, it could point to a number of causes. A CT scan or an ultrasound of the urethra may be needed to further investigate the source of the hematuria.

These screenings will identify the presence of tumors, cysts or stones.

If the suspected culprit is a bladder tumor, a viewing tube may be passed through your urethral opening to the bladder. A kidney tumor is assessed a bit differently; in this case, an angiography s typically performed to study the kidney’s blood vessels.

Of course, hematuria can be none of these things.

Certain medications, cancer, injury to the kidneys, the presence of inherited disorders such as Sickle Cell Anemia, kidney disease or – in rare cases – strenuous exercise can all cause the presence of blood in the urine.

Read more: Can you get life insurance when you have kidney disease?

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Underwriting Hematuria for Life Insurance

The good news is that most of the cases mentioned above will not be cause for a decline. In many of the aforementioned cases, you may not even have to worry about a substandard rating, depending on the state of your overall health.

Small amounts of blood in the urine often indicate a mild and temporary inflammation of the urinary tract. If you do not have any known diseases, these trace amounts of blood will typically be disregarded by underwriters.

Hematuria is measured scientifically by the number of red blood cells per High Power Field (HPF). A High Power Field refers to the area visible under the maximum magnification power of a microscope.

Typically, here is how underwriters look at blood in the urine:

- 1 – 10 red blood cells per HPF: Standard rating

- 11-30 red blood cells per HPF: Standard rating to Table 2*

- 31 – 50 red blood cells per HPF: Table 2 to Table 3*

- 51 + red blood cells per HPF: Table 3* to Uninsurable

If more than 10 red blood cells per power field are found, underwriters will request two additional urine samples taken on different days. If you are a female, this is typically done to rule out menstruation as a culprit.

If no additional blood is found in the urine after these tests then you may qualify for preferred or standard, depending on your overall health.

If the two tests come back and indicate a presence of more blood, underwriters will most likely postpone the process until further investigation has been done.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Getting Life Insurance with Hematuria

As you might have guessed from the earlier information, hematuria is not easy to underwrite on its own.

Fortunately, there are a few preliminary questions your agent can ask if you have ever experienced hematuria related to kidney disease.

Your physician will have to fax over lab findings, all of which will also need to be indicated on your application. These can include the levels of protein or blood found in the urine, your blood urea nitrogen level as well as your creatinine level.

Blood Urea Nitrogen refers to the amount of nitrogen in your blood that comes from the urea, or a waste product made in the liver. Creatinine is a chemical waste molecule that occurs during muscle metabolism.

Additionally, your agent will want to know if you have ever been diagnosed with kidney disease, and the details surrounding the diagnosis (such as the date you were diagnosed, treatments and the name of the disorder.

Further questions concerning your blood pressure levels and family history of kidney or cardiovascular disease may also be asked.

All of these questions can help portray an accurate picture of what may be the cause your hematuria, particularly while underwriters are waiting for official and recent lab tests.

Hematuria does not have to prevent you from finding affordable insurance. More often than not, it is the result of treatable causes such as inflammation or UTIs.

It is important to note that, even if your hematuria is the result of a more serious cause, there are insurers out there who will cover you; it’s simply a matter of doing your research to find the right carrier.

*In life insurance, table ratings are used to allow underwriters to further assess an individual’s risk and to charge their premiums accordingly. The tabled ratings are “standard” base ratings, plus an additional percentage based on risk. For example, Table 2 might be a standard rating plus an additional 25%, and so on.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.